What is an Index?

An index is used to find the changes that take place in the stock market. It measures price movement and market performance. For creating an index, we have to group some stocks from the list of stocks with similar characteristics. This grouping of stocks can be on the type of industry, total market capitalization or the size of the company, or any factors whichever are suitable.

If the price of most of the stocks rises, the index will again rise and vice-versa. Thus, an index is indicative of changes in the market. It reflects the overall market investing sentiment and price movements. Investors and financial managers use this to measure the value of portfolio holding.

Nifty is primarily an equity benchmark index that was introduced on April 21, 1996, by National Stock Exchange. Nifty is an abbreviation of National Stock Exchange Fifty.

The NIFTY 50 represents the weighted average of 50 of the largest Indian companies listed on the National Stock Exchange. It is one of the two main stock indices used in India.

The NIFTY 50 index is the largest single financial product in India, consisting of exchange-traded funds (onshore and offshore), exchange-traded options at NSE, and futures and options abroad at the SGX. NIFTY 50 is the world’s most actively traded contract.

Eligibility Criteria Domicile: The company must be domiciled in India and traded (listed & traded and not listed but permitted to trade) at the National Stock Exchange (NSE).

Eligible Securities: Constituents of the NIFTY 100 index that are available for trading in NSE’s Futures & Options segment are eligible for inclusion in the NIFTY 50 index. Differential

Voting Rights: Equity securities with Differential Voting Rights (DVR) are eligible for inclusion in the index subject to fulfillment of criteria given below:

· Market capitalization criteria is measured at a company level by aggregating the market capitalization of the individual class of security meeting the liquidity criteria for the respective index

· Free float of DVR equity class share should be at least 10% of the free-float market capitalization of the company (voting equity class share and DVR equity class share) and 100% free-float market capitalization of last security in the respective index

· It should meet liquidity criteria applicable for the respective index

· Upon inclusion of DVRs in the index, the index may not have a fixed number of securities. For example, if the DVR of an existing NIFTY 50 constituent is included in NIFTY 50, the NIFTY index will have 51 securities but continue to have 50 companies

·The DVR may be eligible for inclusion in the index whereas the full voting rights security class is ineligible. In such a scenario, the DVRs shall be included in the index irrespective of whether the full voting rights share class is part of the index

The selection of the index set is based on the following criteria:

Liquidity: For inclusion in the index, the security should have traded at an average impact cost of 0.50 % or less during the last six months for 90% of the observations for a portfolio of Rs. 10 crores. Impact cost is the cost of executing a transaction in a security in proportion to its index weight, measured by market capitalization at any point in time. This is the percentage mark-up suffered while buying/selling the desired quantity of a security compared to its ideal price — (best buy + best sell)/2.

Float-Adjusted Market Capitalization: Companies will be eligible for inclusion in the NIFTY 50 index provided the average free-float market capitalization is at least 1.5 times the average free-float market capitalization of the smallest constituent in the index.

Listing History: A company that comes out with an IPO is eligible for inclusion in the index if it fulfills the normal eligibility criteria for the index – impact cost, float-adjusted market capitalization for three months instead of six months. 5 At the time of index reconstitution, a company that has undergone a scheme of arrangement for a corporate event such as spin-off, capital restructuring, etc. would be considered eligible for inclusion in the index if as on the cut-off date for sourcing data of preceding six months for index reconstitution, a company has completed three calendar months of the trading period after the stock has traded on ex. basis subject to fulfillment of all eligibility criteria for inclusion in the index.

Trading Frequency: The company’s trading frequency should be 100% in the last six months.

Index Reconstitution: The index is reconstituted semi-annually considering 6 months of data ending January and July respectively. The replacement of stocks in NIFTY 50 (if any) is generally implemented from the first working day after the F&O expiry of March and September. In case of any replacement in the index, a four weeks’ prior notice is given to the market participants.

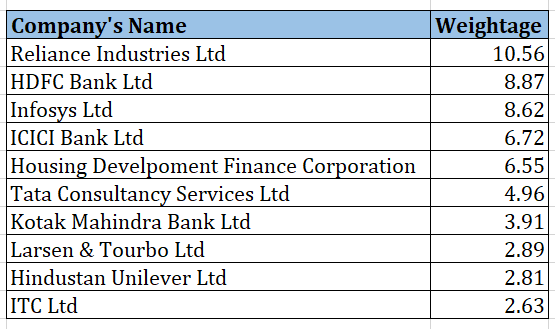

Top constituents by Weightage

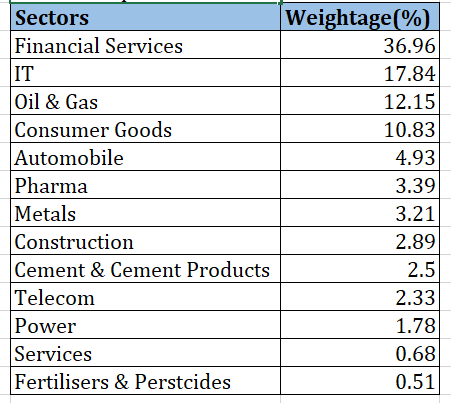

Sectoral Representation