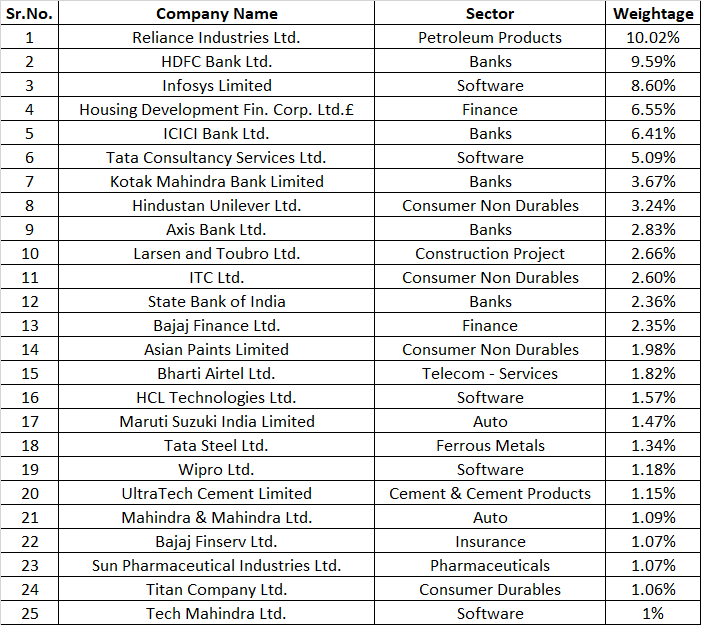

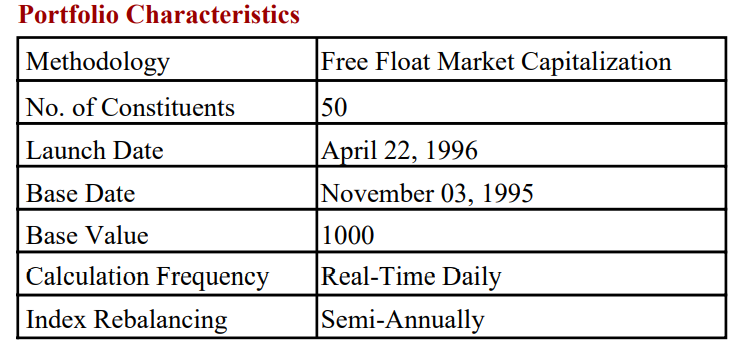

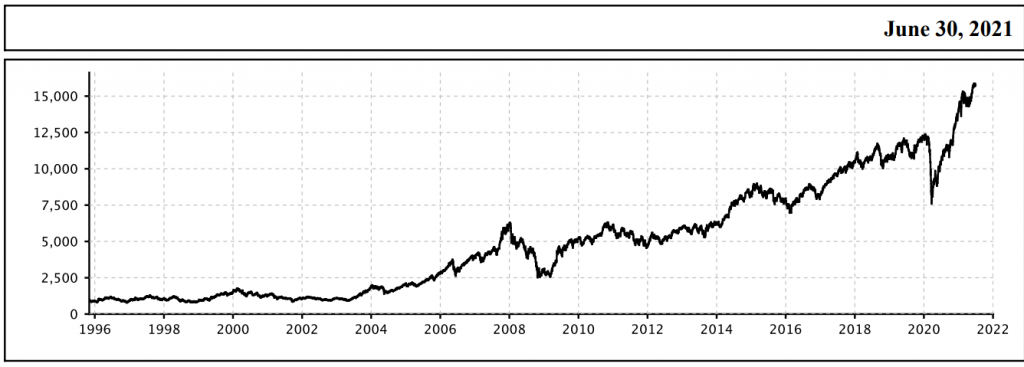

The NIFTY 50 index is a well-diversified 50 companies index reflecting overall market conditions. NIFTY 50 Index is computed

using free float market capitalization method.

NIFTY 50 can be used for a variety of purposes such as benchmarking fund portfolios, launching of index funds, ETFs and structured

products.

Index Variants: NIFTY50 USD, NIFTY 50 Total Returns Index and NIFTY50 Dividend Points Index

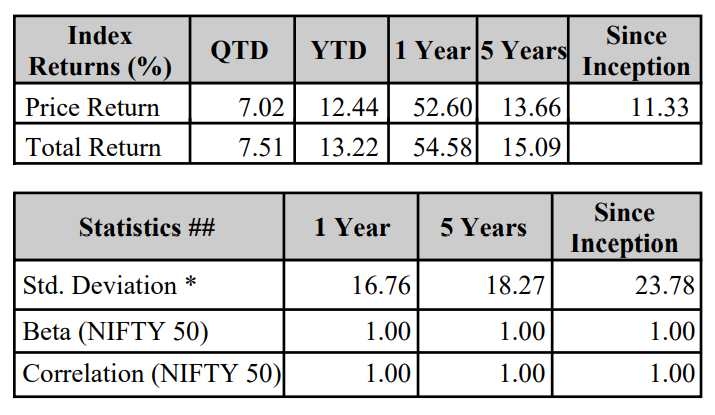

QTD,YTD and 1 year returns are absolute returns. Returns for greater than one year are CAGR returns. Based on Price Return Index

- Average daily standard deviation annualized.

Disclaimer: All information contained herewith is provided for reference purpose only. NSE Indices Limited (formerly known as India Index Services & Products Limited-IISL) ensures accuracy and reliability of the above

information to the best of its endeavors. However, NSE Indices Limited makes no warranty or representation as to the accuracy, completeness or reliability of any of the information contained herein and disclaim any and all

liability whatsoever to any person for any damage or loss of any nature arising from or as a result of reliance on any of the information provided herein. The information contained in this document is not intended to provide any

professional advice.

Index Methodology

Eligibility Criteria for Selection of Constituent Stocks:

i. Market impact cost is the best measure of the liquidity of a stock. It accurately reflects the costs faced when actually trading an

index. For a stock to qualify for possible inclusion into the NIFTY50, have traded at an average impact cost of 0.50% or less during the

last six months for 90% of the observations, for the basket size of Rs. 100 Million.

ii. The company should have a listing history of 6 months.

iii. Companies that are allowed to trade in F&O segment are only eligible to be constituent of the index.

iv. A company which comes out with an IPO will be eligible for inclusion in the index, if it fulfills the normal eligibility criteria for

the index for a 3 month period instead of a 6 month period.

Index Re-Balancing:

Index is re-balanced on semi-annual basis. The cut-off date is January 31 and July 31 of each year, i.e. For semi-annual review of

indices, average data for six months ending the cut-off date is considered. Four weeks prior notice is given to market from the date of

change.

Index Governance:

A professional team manages all NSE indices. There is a three-tier governance structure comprising the Board of Directors of NSE

Indices Limited, the Index Advisory Committee (Equity) and the Index Maintenance Sub-Committee.