Nifty on Fibonacci

We will study the Nifty movement with the help of Fibonacci numbers. It’s one of the moves important and powerful indicators that will help us to arrive at the Targets for the reversal trend. It’s drawn by arriving at the top and bottom of the trend and it’s drawn to arrive at the next set of support and resistance. The higher the Time Frame, the better the results. Here we have taken the Daily charts to draw the Fibonacci Numbers. The drawing remains the same until we get a new high or new low by Nifty. Numbers 38.2% and 61.8% are considered very crucial in the Fibonacci series.

Nifty Analysis :

Let’s study the Nifty Analysis with the help of Fibonacci Analysis. We have drawn the Fibo on the recent Swing High and Swing Low. Data has been taken from the 14th of May 2021 till the 28th of June 2021. This Fibo is valid only until the high of 15915 is not Broken. This Fibo is drawn considering the reversal made since the last two days of June. Nifty made a new LifeTime high on the 28th of June and showing a reversal pattern thereon. If the High gets broken during the Month, then the below Numbers will get active and the new Targets can be easily fetched with the below Image.

For the Analysis, we will consider the new Fibo with the high made on the 28th of June. We will write new Article if the high gets broken.

Nifty has made a new Lifetime high on the 28th of June and started to reverse and this high will also act as Swing High and now we have the opportunity of drawing a new Fibo on Nifty after Many Months. Till now we were using the Old Drawn Fibo with the Fibonacci Extension levels of 138.20% and 161.80% Levels. Now with the help of the newly Drawn Fibo, we can look for the new set of Numbers for Reversal.

On the 30th of June, Nifty has closed below the 13% Retracement Levels and it is a sign of bearishness. The First Important zone of halt would be at 38.20%, however, we have one more potential Reversal zone at the Levels of 23.60% which is at 15603 Levels. Nifty has to close below these levels on a daily Candle to hit the first Important zone at 38.20%.

Further, we have also studied that Nifty is hitting on the Fibo Number on Monthly Candle and this Month Nifty will start showing the Reversal or accelerate the Existing move. I have uploaded a detailed video on the Nifty Analysis for the Month of July in the YouTube Video and here I have also explained about the Fibonacci Time zone. A worthly video to know about the Nifty Move which was predicted well in advance.

Now the Move of Nifty would be Interesting as we will be heading towards a small correction or the existing Trend will pick up speed and we will see the next Levels of 138.20% and 161.80% Fibo levels on the old Levels.

Do Remember that the important levels in Fibo are 38.20% and 61.80%.

Targets for the Month of July- 2021

Coming back to the Targets for the Month of July 2021, Index has halted the bull move for the whole month of July and we had many Gap Ups and Gap Downs and we did see a new Lifetime High. And a round of correction is needed for the next round of healthy up-move. And Index did give a sign of correction on the last two days of the Month. Now we need to wait and watch if the correction continues or Nifty will take support at the Levels of 15750 and start bonce back and start making new highs. This Month we will get more clarity as the Nifty is hitting an important zone on the Monthly chart on the Fibonacci time Zone. This month we will get more clarity on the first day of Trading itself. Any closing that happens below 15700 levels will lead Index to Travel towards 38.20% Levels and we may see a round of consolidation before heading towards the upside. And at 38.20% Retracement levels we will give us a very good opportunity for one more round of Investment.

At the same time, If Nifty stays above 15750 levels, We will see the Index breaking the high again and start making a new Lifetime high in the month of July. Overall this month it’s going to be an Interesting Month.

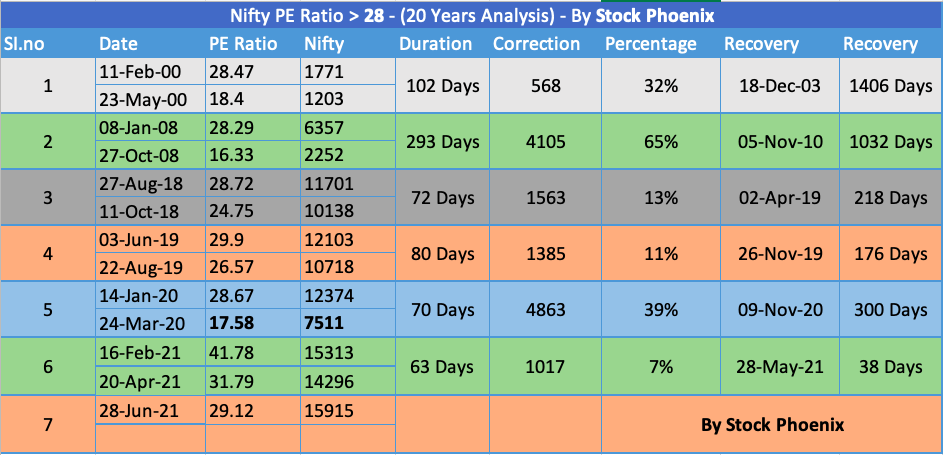

Nifty analysis with the help of PE Ratio.

Nifty has made back-to-back Lifetime high Many times in the Month of June and Nifty PE has hovered around 29 Levels and this is one of the important levels for correction. Find below the Table of PE Ratio Analysis.

What are the Possibilities of Nifty Breaking the Low and Travel high in the Month of July?

Nifty has made back-to-back Lifetime high Many times in the Month of June and Nifty PE has hovered around 29 Levels and this is one of the important levels and that triggers a round of correction. And there is a lot of National news also getting pitched in as far as Pandemic are concerned. News is around regarding the Stimulus package as well and this will affect Index movement. We are going to get very much clarity o the Trend on the very first day of the Month and as Per the Technicals, We will see a round of correction before the next Bull Rally – However, the Upside will continue non stop if the High gets broken in the very first few Trading sessions.

“The Market goes up with rumors and Market Crashes with News.”

Even though the Fibonacci numbers are very accurate, the Fibonacci analysis does not tell anything about the timeline to achieving the targets. For the time frame, we have to take the help of the Nifty Option chain. The near-term target can arrive with the help of the Option chain.

Weekly Expiry – 01st of July

PCR Ratio of the first week shows the sign of Bearishness with heavy Call Writing. We can see a good amount of Call writing seen till the levels of 15900 and not many put writers are active. Nifty has triggered the sell-off after making new Lifetime High and Open=Low. And the major support for the Index is seen at the levels of 15500. If Nifty stays below 15700 levels, then we can expect some correction and that will give us time for making Fresh Investment. Stay tuned with Stock Phoenix Telegram Channel for more live updates on a daily basis.

Monthly Expiry

It’s too early to predict on Monthly Expiry. The overall PCR ratio suggests Bullish. As of now, we could see strong support is getting built up in the zones of 15500 and Resistance at the levels of 16000. This is the same support which we saw on weekly expiry as well. Now it’s pretty clear that on breaking the 15500 we will see a good amount of downside. As Resistance is seen till the levels of 16000 and if Nifty stays above 15500 then we can expect the Nifty to travel high once again.

Immediate Target and resistance

- Upside Targets: 15800, 15930 and 16132 (Above 15750).

- Downside Targets: 15693, 15500 and 15410 (Below 15750)

News that will affect the Nifty Movement

As you are aware that we are on the series of news is coming from the Central government and Global news as well in Terms of Pandemic. Keep a tab on the Global news majority for the month of Match and this will affect the Index. And we do have the quarter Results starting this Month and this will also have a major impact on Nifty’s movement.

Conclusion form Stock Phoenix :

We see Index going one more round of deep cut till the Fibo levels If Nifty stays below 15700 Levels and we are also waiting eagerly for the same to do our next round of Investment. And we are expecting a round of consolidation phase before giving breakout. We will get a clear picture of the closing number on 3th of July. If Nifty stays above 15700 and closing happen above this number, then we would be initiating our first set of Investment for Swing Trading. A good amount of run has already happened in the Small Caps and Mid Caps. Let’s wait and how and what market shows ahead for us. Play safe on the intraday and avoid carry forwarding huge Investment as the Nifty PE Ratio is an alarming stage.

Follow us for more updates on our Telegram Channel

Live Market updates will be given on the Telegram Channel. Please follow Stock Phoenix Public Channel for more updates.

Telegram: https://t.me/StockPhoenix |Twitter: https://twitter.com/stock_phoenix

Leave your valuable comments in the comment section below. And also suggestions to improve our blogging. Your feedback is highly appreciated.