Nifty on Fibonacci

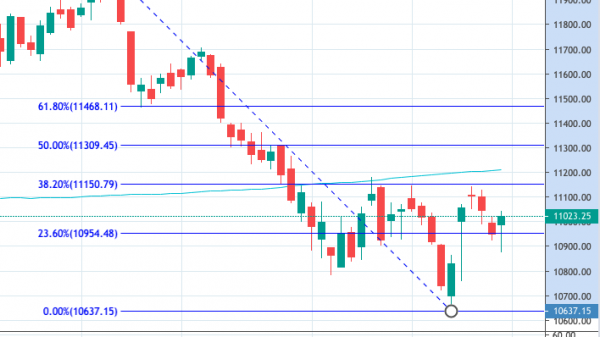

We will study the Nifty movement with the help of Fibonacci numbers. It’s one of the moves important and powerful indicators that will help us to arrive at the Targets for the reversal trend. It’s drawn by arriving at the top and bottom of the trend and it’s drawn to arrive at the next set of support and resistance. The higher the Time Frame, the better the results. Here we have taken the Daily charts to draw the Fibonacci Numbers. The drawing remains the same until we get a new high or new low by Nifty. Numbers 38.2% and 61.8% are considered very crucial in the Fibonacci series.

Nifty Analysis :

Let’s study the Nifty Analysis with the help of Fibonacci Analysis. We have drawn the Fibo on the recent Swing High and Swing Low. This Fibo we have drawn on the very less number of days. Nifty has crossed the Fibo Levels Retracement of 100% and travelled till the Levels of 161.80% Extension levels. We have used the same levels for more than a year. You can refer to previous blogs for more information. The Current Fibo has been drawn on the Low made on 21st of December 2020 and the high made on 16th Feb and this is the Lifetime high. Now this Drawing will remain the same as long as the High and Low are not get broken.

Currently, Nifty has closed below the 38.20% levels and this is the sign of bearishness and the next potential targets on the charts are looking at 61.80% and there at 78.60%. At 78.60% Nifty is going to hit one more Swing Low and this will act as strong support for Nifty. On breaking this we can expect the Retracement to be completed at 100%. At the same, if Nifty is able to cross the 38.20% on the first trading day and any closing happens above this levels will lead Index to bullish Territory and we can expect the higher Targets towards again at a lifetime high.

Do Remember that the important levels in Fibo are 38.20% and 61.80% and currently Nifty is right on one of the Important Levels.

Targets for the Month of March- 2021

Coming back to the Targets for the Month of March 2021, Index made a huge bull run for the month of January and February, and we did see a new Lifetime High in the month of February, and a round of correction is needed for the next round of healthy move. And Index did give a good correction on the last week of February. Now we need to wait and watch if the correction ends over here or will it continues for further downside to complete the 100% Retracement levels. This month we will get more clarity on the first day of Trading itself. Any closing that happens above the 38.20% on Monday will give some sign of relief for the Bulls. And we may see a round of consolidation before heading towards the upside. At the same time if we sell off continues for on Monday, then we just need to sit and relax and watch the show of Bears and catch all the stocks right on the bottom for the next round of Investment.

At the same time, the Low of Friday which 14467 is also a critical number. this was the same now made on 2nd of Feb. And there is a gap between 1st of Feb and Second of Feb. Now on Monday if the low of Friday get’s broken, then we can expect this gap to be filled quickly. Overall if we analyse the charts, the Low of Friday should not get broken. If it’s get broken, then we will a good one more of a deep cut in Index and that gives us a very good opportunity for one more round of Investment.

What are the possibilities of Nifty breaking the low or travel upside in the Month of March?

Nifty has made back to back Lifetime high Many times in the Month of February and Nifty PE has hit the lifetime at 42 Levels and this is a historic number that we have never seen in Nifty since its inception. And that triggers a round of correction and the correction did happen. However comparing the to bull run which has happened, this correction is very small. And the correction happened due to the Negative Global news which occurred on the last trading day of February. And there is a lot of National news also getting pitched in as far as Pandemic are concerned. And over the weekend we have got some Positive news also across Global. Now the move of Monday will be decided as to how the Investors will react to this news. So for the Month of March, the Move will be decided based on the news. It’s going to be a news Trading Month and hence we can expect a lot of Volatility.

“The Market goes up with rumours and Market Crashes with News.”

Even though the Fibonacci numbers are very accurate, the Fibonacci analysis does not tell anything about the timeline to achieving the targets. For the time frame, we have to take the help of the Nifty Option chain. The near term target can arrive with the help of the Option chain.

Weekly Expiry – 04th of March

PCR Ratio of the first week shows the sign of Bearishness with heavy Call Writing. We can see a good amount of Call writing seen last Friday at the levels of 14800 and not much put writers are active. Nifty has triggered the sell-off due to the Global news. And still, the major support for Index is seen at the levels of 14500. Any Put unwinding at these levels on Monday will lead to weakening the support levels and we can expect the Friday low getting broken and head towards the next level of downside targets. If we hold above 14500 then we can expect some sort of recovery. Stay tuned with Stock Phoenix Telegram Channel for more live updates on a daily basis.

Monthly Expiry

It’s too early to predict on Monthly Expiry. The overall PCR ratio suggests Bullish. As of now, we could see strong support is getting built up in the zones of 14500. This is the same support which we saw on weekly expiry as well. Now it’s pretty clear that on breaking the 14500 we will see a good amount of downside. Resistance is seen till the levels of 15000 and if Nifty stays above 14500 then we can expect the Nifty to travel high once again.

Immediate Target and resistance

- Upside Targets: 14888, 15132 and 15431 (Above 14553).

- Downside Targets: 14281, 14010 and 13623 (Below 14553)

News that will affect the Nifty Movement

As you are aware that we are on the series of news is coming from the Central government and Global news as well in Terms of Pandemic. Keep a tab on the Global news majority for the month of Match and this will affect the Index.

Conclusion form Stock Phoenix :

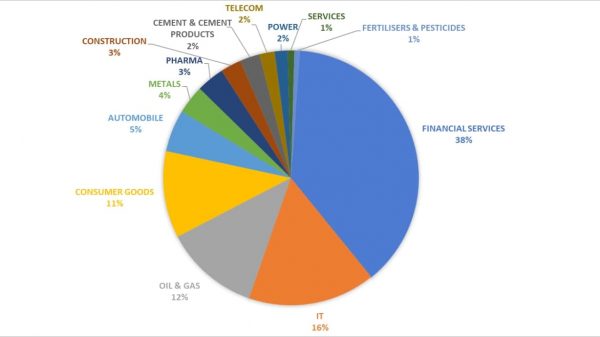

We see Index going one more round of deep cut below 14500 and we are also waiting eagerly for the same to do our next round of Investment. And we are expecting a round of consolidation phase before giving breakout. We will get a clear picture of the closing number on Monday. If Nifty stays above 14500 and closing happen above this number, then we would be initiating our first set of Investment for Swing Trading. A good amount of run has already happened in the Small Caps and Mid Caps. FMCG and Pharma Sector is the ones which we are going to focus on for the month of February as these stocks have seen a good downfall and reversal is long due. Let’s wait and how and what market shows ahead for us. Play safe on the intraday and avoid carry forwarding any kind of CE or PE option for the next day as the Month is going to Gap Up or Gap Down due to the News and as we mentioned earlier, this month Movement is going to be based on news and we generally avoid trading based on News.

Follow us for more updates on our Telegram Channel

Live Market updates will be given on the Telegram Channel. Please follow Stock Phoenix Public Channel for more updates.

Telegram: https://t.me/StockPhoenix |Twitter: https://twitter.com/stock_phoenix

Leave your valuable comments in the comment section below. And also suggestions to improve our blogging. Your feedback is highly appreciated.