When new investors/traders enter the stock market, most of the time they are disappointed when their purchase value drops. We have a popular saying about the stock market “Stock Market is a Gambling”, unfortunately to some extent, this statement is True and is also proven.

Almost 90-95% of people lose money in Stock Market. Very few people make money in the market. Do you wonder why it is due to some very common mistakes most of these 90-95% of people do while they put their hard earn money in Stock Market?

Let us discuss a few common mistakes which people do when they enter the stock market:

Subscribing for free tips:

Due to lack of knowledge and scarcity of time to learn, we tend to look for tips providers either free or paid. Initially, we tend to go with our friends and family members’ suggestions who have already invested in the stock market or we will go with social media accounts, TV channels, or paid tips providers.

This is a very common mistake most people do and lose money in Stock Market.

The temptation for quick money:

Whenever a person enters the stock market, they think it is an easy way to may money and tend to start Intraday trades and Futures and Options trading without proper knowledge.

No stock will have a trader/investor rich overnight.

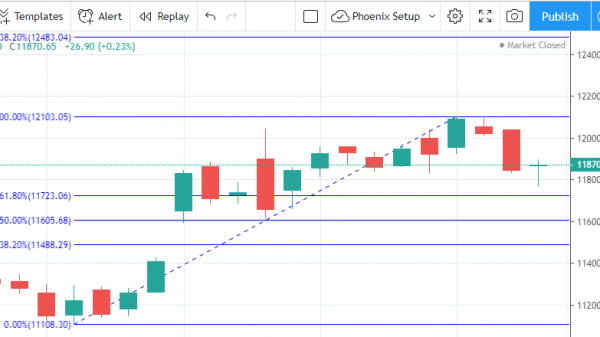

Averaging the stocks:

When we buy a stock and it is making new highs, we feel happy. But, we get frustrated once it starts moving in the opposite direction. Nobody likes correction in a stock when they have a position.

In correction we try to average it down, hoping for a bounce, which may or may not happen.

Averaging should be done wisely as nobody can tell the bottom of the stock.

In Stock Phoenix, we consider “Averaging as CRIME”.

Lack of Knowledge:

Before buying a Mobile or Television we look on different websites, shops – compare different brands, and decide, However, while buying stock we buy because it is rising and not sure of Why, When, What, How? (Why I am buying, When will I exit, What will be my expectation, How the stock will perform).

Improper Financial Planning:

This is also a very common issue, especially with the Salaried Class. Now, most of the salaried class know the long-term benefits of investing in the Stock Market. So, either they start investing directly in stocks or use the Mutual fund route to invest through SIP.

But before starting investment in Stock Market, they miss a few common necessary steps such as budgeting, reducing high-interest debts, maintaining an emergency fund.

Many of us ignore the Importance of the Emergency Fund and in case of emergency, we go for pre-mature withdrawal of our investments which we have planned for some other goals. Due to this pre-mature withdrawal, if Market conditions are not in your favor you might book losses on your investment made in stocks and mutual funds.

Speculation:

We tend to invest in the short-term to take the advantage of price movement, Intraday Trading, BTST (Buy Today Sell Tomorrow), Swing Trades – all these are speculation and can end up in loss if not managed properly.

In speculation Chances of making money always remain very high and chances of losing money will also remain very high.

Closing Thoughts: Learn the basics of business, basics of industry sectors and identify how to analyze them. Once you have the right knowledge, you will be able to identify good stocks on your own.

If you don’t want to lose money in the stock market try to become a value investor and invest for the long term.