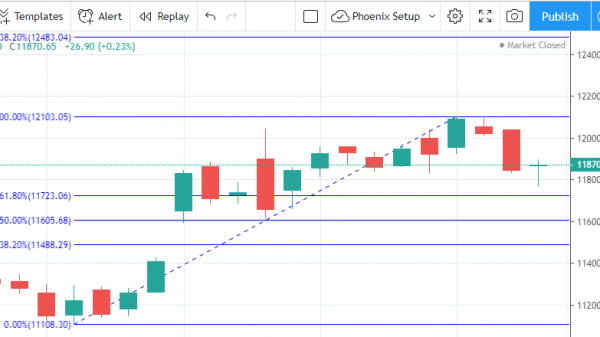

Gaps in the stock market appear when there is a sharp rise or fall in the price of the stock and when there is no occurrence of the trading activity.

Gaps are the space between the open and the closing prices of two consecutive days and such gaps normally get filled. The gap can be an important indicator to the trader in identifying the trading opportunities on the stock.

The reasons for gap creation can be a positive or negative news release by the company, change in the trade analyst’s view, buying or selling pressure among traders, public announcements of the company’s profit, Stock rating by rating agencies, and so on.

Gaps result from extraordinary buying or selling interest developing while the market is closed. The gap is basically formed because of the imbalance between the supply and demand which occurs due to a heavy rush towards either side.

Gap Up:

A Gap Up is when a stock opens at a higher level than the previous day’s high.

For example, if the previous day’s high was 600, and the stock opened at 660, there would have been a 60 point gap up, 10% appreciation at the open. This is considered a bullish signal and the stock continues to be trending(upward) for the whole day until a specified circuit limit is hit.

Gap up can be divided broadly into 2 types, namely:

Full Gap Up: During the start of the session the price of the stock opens higher than the previous day’s high.

Partial Gap Up: During the start of the session the price of the stock opens above the previous day’s close, but not above the previous day’s high.

Gap Down:

A Gap Down is when a stock opens at a lower level than the previous day’s low.

For example, if the previous day’s high was 600, and the stock opened at 540, there would have been a 60 point gap down, 10% depreciation at the open. This is considered a bearish signal and the stock continues to be trending(downward) for the whole day until a specified circuit limit is hit.

Gap down can be divided broadly into 2 types, namely:

Full Gap Down: During the start of the session, the price of the stock opens lower than the previous day’s Low.

Partial Gap Down: During the start of the session, the price of the stock opens below the previous day’s close, but not below the previous day’s low.

Closing Thoughts:

There are many techniques to take advantage of the gaps in the stock market. Some traders will purchase the stock due to technical or fundamental reasons as a supporting confirmation when there is a gap on an opening day.

Once a stock starts to fill a gap, it will not stop as there will be little or no support or resistance in the market. Volume should be considered whenever the stock tries to cover the gap.

It is always advised to check the trend before trading the Gap, as the gap can give huge returns or a huge dent to the portfolio.