Importance of Money Management

Everybody knows, “In Ramayana, Rama told Ravana to go today and come back tomorrow for a fight.” Likewise, if you lost all your capital on day one, how you can trade the next day???

No money, No confident to go for trade after losing all capital in one day, believe me, it can affect your trading life and personal/professional life. But if you know proper money management techniques and control your emotions and make a trade with technical analysis, you can stay in the market for a long time as a successful trader.

E.g., In trade, if you are buying stocks for RS 10000 and if you are losing RS 3000 without money management and believe me you can stop this loss between RS 500 to 200 (5 to2%) if you use proper money management.

Like any business in share market also will have up and down, Market will be cruel some days and kind some days to you. When it is cruel if you control your loss and stay in the market when the kind day comes, you can achieve the success you desire. Money management will help you do all of this. Let’s go straight into topic and understand money management.

Set your mind

First, don’t go for trade blindly. If you have 1 lakh capital first fix how much profit you want 15% or 25% or 40%. Higher the expectation you are willing to take more risk first understand that. In a month having 22 trading days, you don’t need to trade all days. “No trade is a good trade.” Other than losing capital, it is better to avoid trade with compromising your technique. If your technique is not giving the green signal, don’t trade for the day or a week also, but don’t enter in a wrong trade.

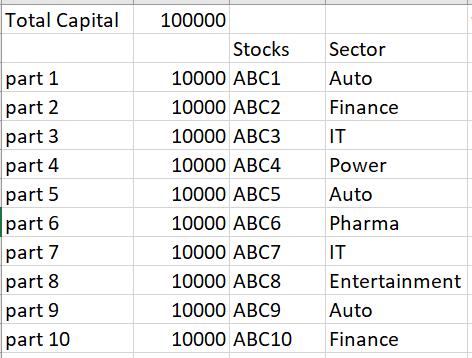

Divide and Invest

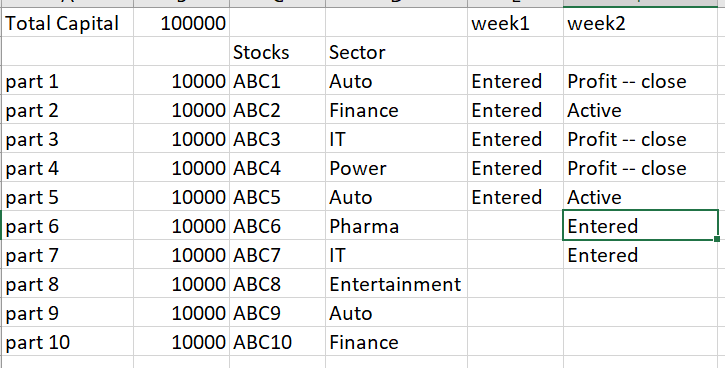

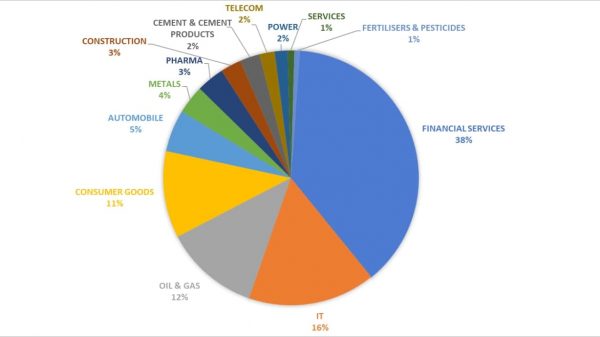

As we discussed if you have 1 lakh capital, don’t buy a single stock for all your money. Divide your money as 10 parts and invest in 10 stocks. Again divide the sectors not only in AUTO, FINANCE, POWER, PHARMA sector. Invest in multiple sectors so we can avoid loss if you entered in one sector and that sector starts moving down. Also, make a trade in a cycle format, the first week enters in 5 trade and next week which stocks are in profit close that positions and enter in new trades. E.g., if you are entering in 5 trades in the first week and the next week 2 trade are reached your expected target so close that trade and book profit. So currently 3 trades are active and take a few more trades and repeat the cycle.

Cycle Format

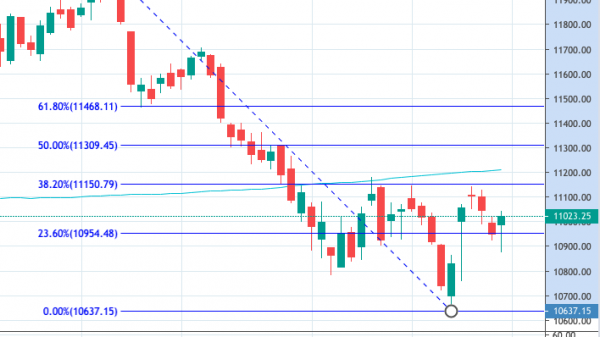

Strict STOP LOSS.

Why stop loss is so important?

No one worries when your trade is making a profit. What will happen when the trade moves in the wrong direction? If you are not calculated your stop loss before entering the trade, you can lose a big part of your capital because you don’t know when to exit when stocks are moving down.

Take an example; you are buying 100 quantity for ABC stock for 1000 RS, and it is started falling, and you exited in 980RS of loss 20 points. Another trade you are buying 100 quantity of ABC stock for 1000 RS and your stop loss is 7RS, and it came to 993RS, so you exited. In the first trade, you lost 100*20=2000RS and in second trade 100*7=700RS. So you saved your 1300RS in your capital to go for the next good trade which will cover this loss.

Easily, you can lose 2000RS in a trade, but to recover 2000RS from the market, you need a good amount of time. Why I believe the stop loss is a heart of trade in share market for all trades is. Consider a company going to launch a product; it may fail or succeed. They invest 10 Crore in that product for R&D, manufacture, and promotion, and finally, if the product failed, they would lose 10 Crore. But in share market, if you are investing a lakh in a trade, you don’t have to lose all your money. You can stop your loss by keeping a strict stop loss of 5% to 10% depends on your risk appetite.

So, you lost only 5000RS when the trade goes wrong, and you have 95K for the next trade which may go perfectly.

Note of Thanks:

My sincere thanks to Mr.Prabhu sir for giving me this opportunity and Mr.Senthil sir for giving me knowledge which makes me able to write this article.

Disclaimer:

Some Images are copied from Google, and if any copyrighted image is used by me, please notify, and it will be removed from the article. Stock Phoenix is not responsible for this article; I am the owner of it.

17 Comments. Leave new

Welcome to the world of Stock Phoenix blog.

Good article !!

The good initiative was taken

Very good article.

Money management is very important in stock market

Most of us enter in to the market blindly and lost our capital, nice article. Everyone will be aware of keeping strict stop loss, all these we learnt from stock Phoenix team. Thanks to Mr. Prabhu, Senthil and his team for bringing successful traders into market by learning technicals. Their way of teaching is so simple and makes learning the technicals easy. I will suggest more people to join the course for successful trading.

Very informative..

I only wish I knew this before I lost 70% of my funds in the past. Most traders get anxious when in profit and curious when in loss. This results in an inverse risk:reward ratio. After joining Stock Phoenix, I have learnt to manage my funds and this article perfectly sums the mentality of a successful trader. I recommend this to anyone who wants to enter or re enter the market.

Article is informative, but please use different stock names (ABC is used frequently, instead you would have used different name)…

Very nice initiative SP team keep up the good work.

Everyone need to read Strict Stop Loss related information minimum 10 times as all beginners makes this mistake by default.

Good awareness for all.

Good one.

Nice article. In stock market to be a scuccessful trader one need to have money management and in this post it is being explained very well

I’ve been surfing online greater than 3 hours lately, yet I never found any fascinating article like yours. It?¦s lovely worth enough for me. Personally, if all site owners and bloggers made excellent content as you did, the net will be a lot more useful than ever before.

Just want to say your article is as astonishing. The clearness for your publish

is simply excellent and i can assume you’re an expert on this

subject. Well together with your permission allow me to snatch your feed to keep up to date

with imminent post. Thanks 1,000,000 and please keep up the gratifying work.

I used to be recommended this web site by means of my cousin. I

am now not sure whether this submit is written via him as no one else recognize such

certain about my difficulty. You are wonderful!

Thank you!

Fantastic web site. Lots of useful info here. I am sending it to a few friends ans also sharing in delicious.

And certainly, thank you on your sweat!

Wow that was odd. I just wrote an extremely long comment but after I clicked submit my comment didn’t appear.

Grrrr… well I’m not writing all that over again. Anyway, just

wanted to say great blog!